March 11, 2025, U.S.A.

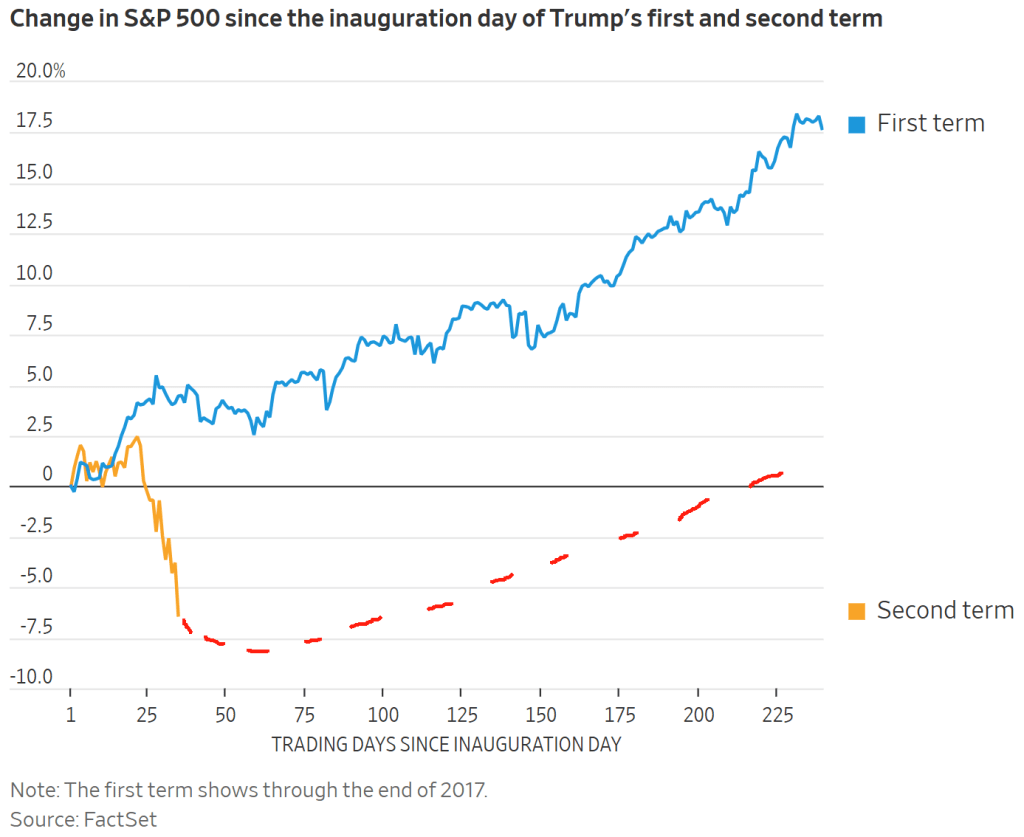

As of this writing, the U.S. equity markets have been downward-trending for the past several weeks. I believe it will continue for the foreseeable future. To assist my argument, please see the chart below:

Source: The Wall Street Journal

The red dash line was added by me. I believe this red dash line is the best case scenario that the U.S. equity market investors can hope for, which basically mirrors what happened for the first Trump term. If this scenario plays out, we can conclude that: (1) there are still at least another month toward the end of April that the equity markets will bottom; (2) the uptrend after that will be more than 10%.

But this is the best case scenario in my mind, and I believe the probability of this realizing is low. This is because we are experiencing a quite different Trump second term from the first term, especially when Trump and his team are much more determined to execute their economic policies, including and especially tariff policies. The tariff policies of the Trump administration is almost a war policy against many sides of the U.S. society and the world, and the Trump administration believe they can win on many fronts, although I am not fully convinced of that.

There are several reasons why I believe this is a difficult war for the Trump administration to win if they continue the current policy approach and ideological drumbeats: (1) the world is different now, in that many other major trading partners of the U.S. are stronger (politically and economically) than what the Trump administration believe; this means that the retaliations will be swift and hurting to the U.S. economy; (2) “detoxing” (using U.S. Treasury secretary Scott Bessent’s term) is the right thing for U.S. economy to do, but it will lead to many physiological disturbances and requires careful managements and guidance which are lacking in these first several weeks of the Trump administration; (3) the U.S. is highly divided politically, and there will be strong dissents from at least part of the society; the Trump administration may just ignore that, but the U.S. politics does not work the way that Trump wishes for or insists on. Note that the economic inequality in the U.S. caused by the globalization process of the previous many years can be further exacerbated by the current Trump policies before it is reduced by the Trump policies, if that ever happens or can eventually reach expected effects.

All of the above reasons indicate that the U.S. equity markets will be under huge pressure and can go down 15% (my base case) to 25% (my worst case) at least from it peak in February. That will lead the SPX to 5250 or 4700, respectively.

As of now, fingers crossed, and I will re-visit this topic in a few weeks.